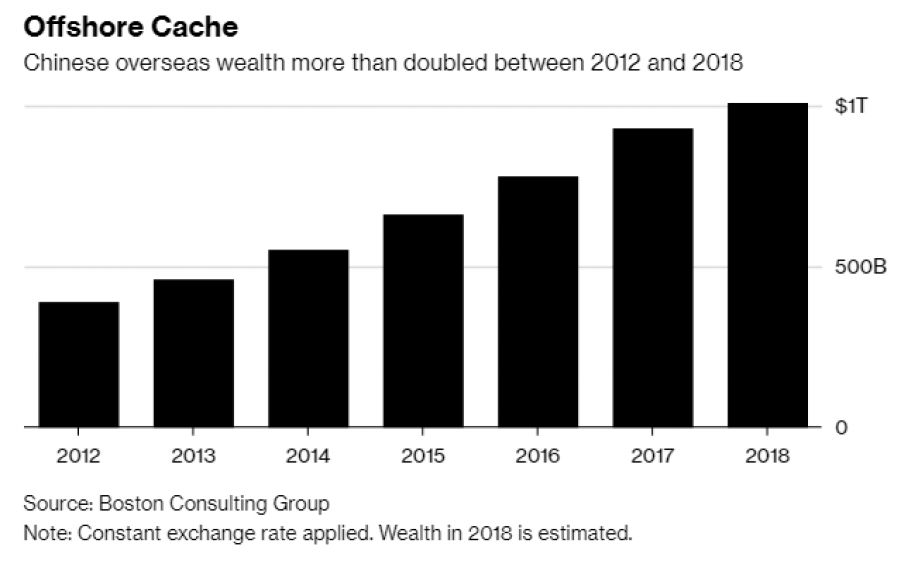

Wealthy Chinese are rushing to shelter assets and income in overseas trusts before new tax rules go into effect next month, including provisions that target offshore holdings.

The Bank of Singapore has seen a 35 percent surge in Chinese clients interested in offshore trusts since the second half of 2018, according to Woon Shiu Lee, head of wealth planning at the bank. The rate of inquiries leading to the establishment of a trust, which offers “tax-planning opportunities” by giving ownership to third-party trustees, has doubled since August, he said.

The reforms, which take effect Jan. 1, are meant to reduce the tax burden on...