Just a month earlier, in March, the Dubai-based bank Emirates NBD issued the Gulf's first renminbi bond. América Móvil became the first South American company to raise funds in renminbi in March, when it issued a one billion renminbi bond, and South Africa's Standard Bank launched yuan services in 16 African countries at the end of last year, not long after Deutsche Bank announced its own offshore renminbi vehicle, an investable benchmark index that tracks renminbi bonds issued outside the mainland.

Despite the flurry of activity, HSBC's London bond stood out. It success was announced by George Osborne, the UK's Chancellor of the Exchequer, who called the offshore renminbi market the "next step in a 400-year-old road" for London and borrowed a Chinese idiom to express his hope that it would grow from "a small acorn nto a large oak tree." By most standards, HSBC's issuance was small, but because London is the world's largest foreign exchange market, handling more than a third of all transactions globally, it was regarded as an important milestone on the road to a fully convertible renminbi.

"HSBCis a strong, solid name coming to the market," says Paul Gooding, the company's Head of European RMB Business Development."The bond was issued out of London in the London time-zone, and aimed at European investors. It was also listed on the LSE (ORB), making it easier for retail clients to transact. The success of the bond - 60% European participation - comfortably highlights the appetite and growth potential for RMB products in Europe."

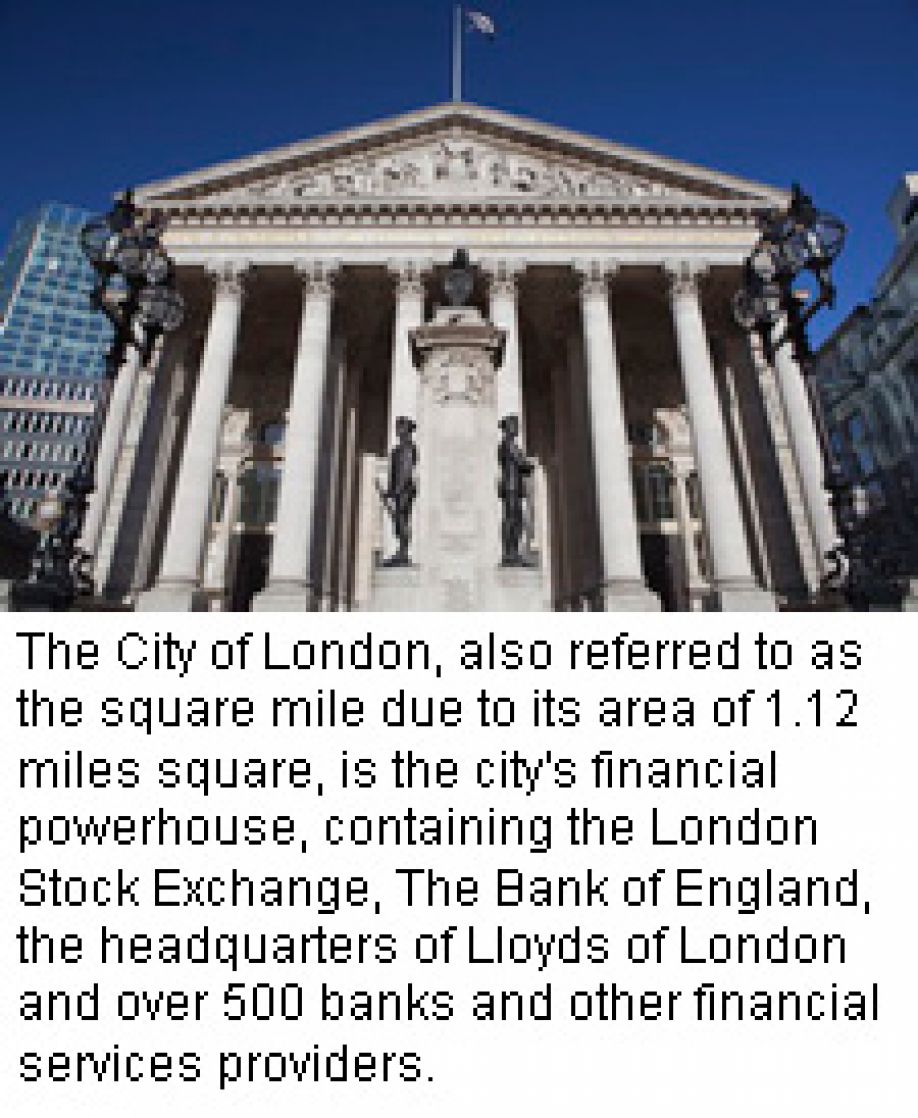

Mr Gooding rightly emphasises fundamentals, but there was an also an aspect of showmanship in the bond's success. HSBC, which is Europe's largest bank, timed the launch of the bond to coincide with the City of London Corporation's announcement that it had formed a working group to look into developing the city's offshore yuan business, with the aim of turning London into a global renminbi market.

Renminbi bonds sold offshore are normally referred to as Dim Sum bonds, a name they picked up in Hong K0ng, where dim sum is a popular mix and match Cantonese snack. China Development Bank issued the first Dim Sum bond in July 2007, starting a three year period during which they could only be issued by mainland and Hong Kong-based banks. When that rule changed, in July 2010, McDonald's was the first foreign, non-financial company to take advantage of it. A total of 35.7 billion yuan in Dim Sum bonds were issued in Hong Kong that year, growing to 131 billion in 2011. The Hong Kong market has continued to grow, with RMB50.7 billion sold in the first quarter of this year alone.

Demand for Dim Sum bonds is largely a result of China's capital controls, which prevent foreigners from investing in domestic debt. The Chinese government intends to loosen its grip on the domestic market before too long, but until it does, Dim Sum bonds are the only way for investors to gain exposure to renminbi denominated debt and bet on the appreciation of the yuan, whatever the yield.

London has a long way to go before it can compete with Hong Kong's overall volume, but it well positioned to be the preeminent centre outside the People's Republic. "Hong Kong is the natural choice to be the offshore RMB centre," says Paul Gooding. "China's twelfth five year plan explicitly names Hong Kong's offshore business as a pillar industry that China will actively support, and London can learn a lot from Hong Kong's efforts at internationalisation over the past two years. Hong Kong has a trusted working relationship with onshore and offshore regulators, and is the primary centre for mainland China on the flows of trade, people and capital, and this knowledge should be hugely beneficial to London."

Beijing has given a nod of approval to HSBC's Dim Sum offering, after George Osborne and Chinese vice-premier Wang Qishan agreed to collaborate on the development of London based, renminbi denominated financial products and services at a meeting last year. The issuance, on April 18, came just a week after China widened the trading band of the renminbi to one percent, increasing the rate at which the otherwise dollar-pegged currency is allowed to appreciate and depreciate. The renminbi's trading band was last widened four years ago, from a daily limit of 0.3 percent to 0.5 per cent.

"What's changed is an awareness in China of the need to deepen the international market for the RMB," says Nigel Pridmore, a partner at Linklaters, a law firm that has helped to develop the legal framework for the Dim Sum market. Paul Gooding agrees. "Liquidity," he says, "is the main concern of investors. Deal sizes are still relatively small, and the market needs to establish hedging tools. Better hedging tools - like government bonds, swaps and futures - should lead to larger sized deals, attracting larger Institutional investors."

Mr Gooding says that at the Hong Kong-London held in May, "everything seemed to come back to liquidity and education. HSBC's view is that this market has to grow through trade - it is through the growth of trade with China that renminbi liquidity pools will increase, and better liquidity - market liquidity as well as liquidity pools - will enhance product offering, including more liquid Dim Sum bonds, renminbi funds and IPO's. And trade growth will only expand through continued education of our customers on the benefits of the renminbi and education on the constantly changing regulatory environment."

China has only allowed trade settlement in renminbi since July 2009, when it launched a pilot scheme restricted to transactions between Hong Kong, Macau and the ASEAN countries. A year later, the scheme was expanded to include every country in the world as well as 20 Chinese provinces and municipalities, allowing all imports and exports to be invoiced and settled in renminbi. The scheme took off slowly, but according to the People's Bank, RMB340 billion of trade was settled in renminbi between June and November last year.

The post-trade specialist Euroclear estimates that deposits worth RMB576 billion are now held outside China, mostly in Hong Kong. Dan Kuhnel, Euroclear's Director of Primary Market Relations recently told Reuters that much of this idle cash, generated through trade settlement, is likely to used for securities investment. "Investors are eager for more issuances to come to market," he says.

Kuhnel thinks the London market is aimed at improving liquidity and putting available renminbi deposits to use, but there signs that bond issuance out of China is slowing down. According to a Financial Times report in May, yields have risen considerably over the past year. An index of 120 Dim Sum bonds maintained by the Bank of China that had an average yield of 3.5 percent last year was up to an average of 5.6 percent at the end of last month as a result of falling prices.

The same Financial Time report quotes Becky Liu, a strategist at HSBC, who has calculated that out of the of the RMB 103 billion in bonds and certificates issued by May, only eight percent came from Chinese corporations. "The cost of funding in the offshore renminbi bond market has now surpassed that in the offshore US dollar bond market," Liu told the Financial Times, which might make it difficult for the still poorly understood Dim Sum market to gain traction outside of China.

"Personally, I think it will stay co-operative," says Paul Gooding. "AtHSBCwe pride ourselves on being able to offer renminbi products and services across all time zones, with foreign exchange pricing 24 hours a day. We were the first international bank to settle cross border trade in renminbi across 6 continents, so although Hong Kong will undoubtedly remain the primary centre, we will continue to look at the business globally. London benefits the market by providing it with a western hub, including a time zone that covers Asia, the Middle East, US and Latin America, along with a history of innovation, its pre-eminence as a foreign exchange centre globally and a supportive government."

China has clearly stated its aim for the internationalisation of the renminbi: it wants "basic" - if not complete - convertibility by 2015, and it is moving tentatively in that direction. London was and is an important part of that transition, but perhaps it is worth remembering that China did not match the British government's breathless excitement. Dim Sum bonds are a new and not particularly neat solution to the problem of China's closed markets and strict currency controls. It is as yet unclear exactly what China means by "basic" convertibility, and until it is, the market will probably stay small. The RMB131 billion of 2011 was, after all, not much to get excited about when compared to the US bond market, which added up to US$32.3 trillion in the same year.