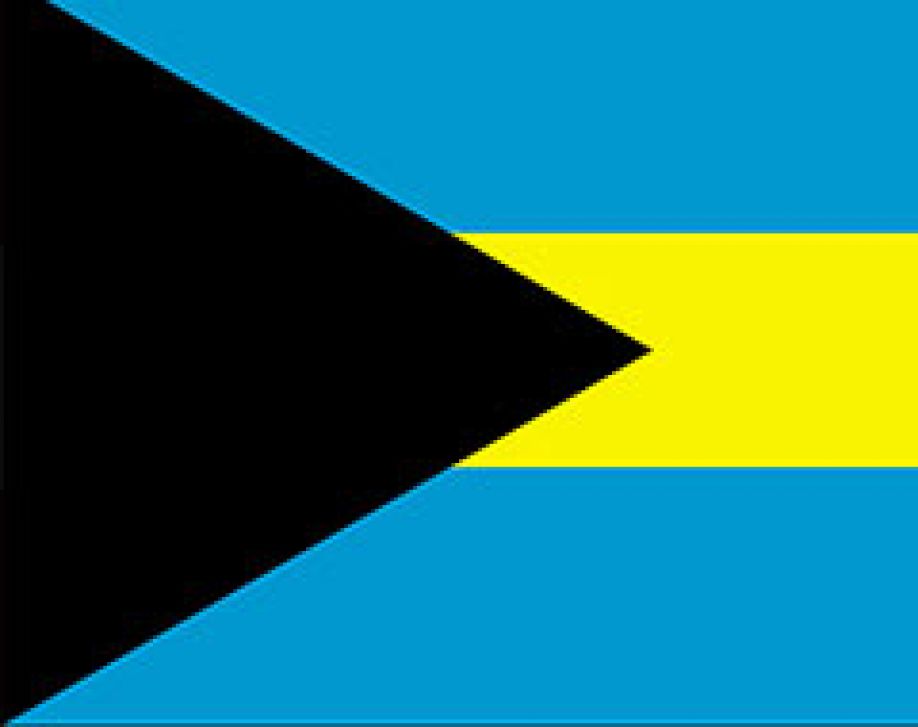

The Bahamas became independent from the UK in 1973, although the Queen remains Head of State. Beginning 50 miles off Florida, in the Caribbean, the Bahamas has 700 islands and a population of just over 350,000. The official language is English.

The capital is Nassau, there are a number of international airports with good connections, and there are excellent port facilities.

The climate is sub-tropical. The Westminster-style government is business-friendly. In May 2012, voters ousted Prime Minister Hubert Ingraham's Free National Movement Party, with 29 of the 38 House of Assembly seats going to the Progressive Liberal Party led by...