The capital is Nassau, there are a number of international airports with good connections, and there are excellent port facilities.

The climate is sub-tropical. The Westminster-style government is business-friendly. In May 2012, voters ousted Prime Minister Hubert Ingraham's Free National Movement Party, with 29 of the 38 House of Assembly seats going to the Progressive Liberal Party led by Perry Christie. Mr. Christie was sworn in as Prime Minister on May 8, 2012.

Economy Based on Financial Services and Tourism

The Bahamas was a trust and tourist jurisdiction very early in the 20th century, but was relatively late in developing as a financial centre. The economy is heavily dependent on tourism (4m visitors a year), but financial services are growing in importance. GDP was USD11.24bn in 2012 (est) at purchasing power parity, and GDP per head was about USD31,900 in 2012 (est) at PPP. This is above average for the region, but well behind the most successful (and smaller) jurisdictions such as the Cayman Islands and the British Virgin Islands. The global financial crisis left its mark on the country's economy with GDP contracting and the budget deficit increasing. However increased tourism, particularly from the US and new investments, have reversed the decline. Investment in the tourism sector and increased visitor numbers are vital for further growth.

The economy is heavily dependent on tourism, but financial services are growing in importance. There is a stock exchange (BISX) but it has struggled to develop a secure financial base in the absence of promised privatizations. Leading sectors are banking (278 banks at the end of 2011) and mutual funds (713 at the end of 2011). Trust management is also prominent. Offshore operations take place through International Business Companies or other tax-exempt forms. The insurance sector has assets of USD1.3bn. Professional services are excellent. The shipping registry has been very successful for larger vessels. There is no income tax, capital gains tax, VAT, sales or use tax or wealth tax. Annual government fees are imposed on businesses and there are national insurance, stamp duties and property taxes. The Bahamas has signed 28 Tax Information Exchange Agreements.

|

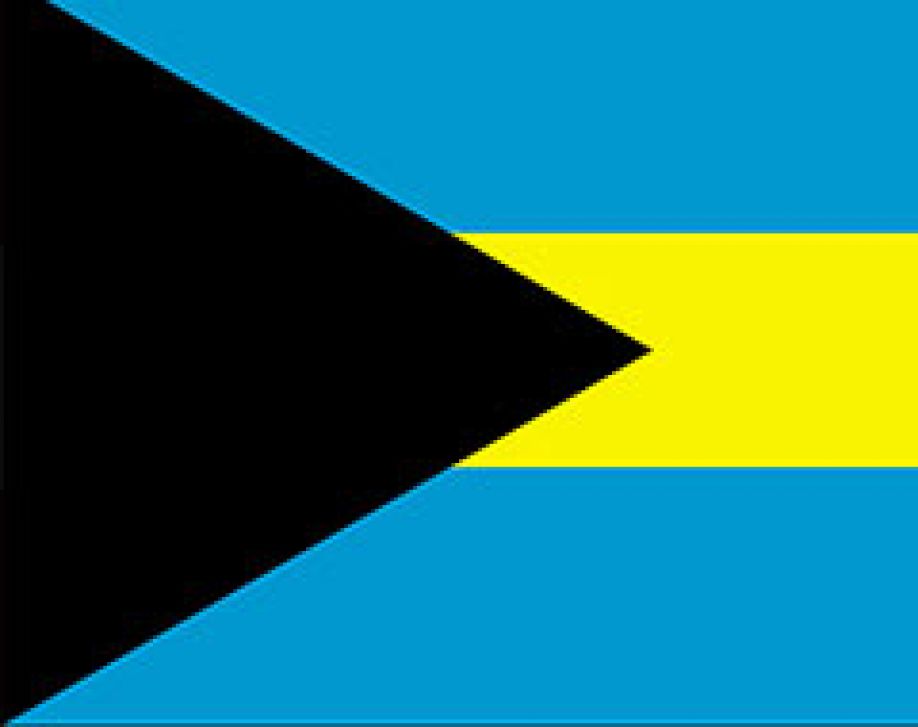

COUNTRY:

|

BAHAMAS

|

|---|---|

|

Region:

|

Caribbean

|

|

Currency:

|

Bahamian Dollar (BSD) (B$)

|

|

Languages:

|

English

|

|

Time Zone:

|

UTC -5

|

|

Phone Code:

|

+1242

|

|

Communications:

|

Good

|

|

Formation Cost:

|

1300 - 2900 USD$

|

|

Formation Time:

|

9 - 15 days

|

|

Maintenance cost:

|

1000 - 2000 USD$

|

Suitable for:

- Wealth Management,

- Banking, Shipping,

- Aviation, Yachting,

- Intellectual Property/Licensing,

- Holding Companies

Vehicle Types:

- Limited companies,

- public limited companies,

- trusts,

- foreign companies,

- limited partnerships,

- exempted limited partnerships and segregated account companies

Capital primary business districts:

Nassau

Good Relationships:

Barbados, Belize, Bermuda, British Virgin Islands, Cayman Islands, Dominica, Jamaica, Montserrat, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and the Grenadines, Suriname, Trinidad and Tobago, Turks and Caicos Islands, United Kingdom, United States

Bad Relationships:

Burma, Cuba, Iran, Korea (Democratic People's Republic of), Libya, Somalia, Sudan, Syria

Tax Burden - Business:

Very Light

Tax Burden - Individual:

Very Light

Headline tax rates:

CIT 0%, PIT 0%, VAT 0%

Treaty Jurisdictions:

None

TIEA Jurisdictions:

Argentina, Aruba, Australia, Belgium, Canada, China, Czech Republic, Denmark, Faroe Islands, Finland, France, Germany, Greenland, Guernsey, Iceland, India, Japan, Korea, Republic of, Malta, Mexico, Monaco, Netherlands, New Zealand, Norway, Poland, San Marino, South Africa, Spain, Sweden, United Kingdom, United States