By Baron Laudermilk.

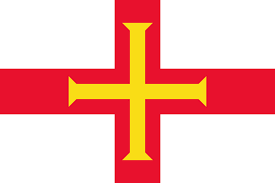

Guernsey is a small but respected island sitting in the waters between France and England. It has established a worldwide reputation for being an international financial offshore center that provides services for all levels of investors and business owners. Despite being small, it contains a large amount of money, funds and professional financial companies and banks. It has more than £97bn in bank deposits, more than £ 274bn in funds, and has around 33 registered banks.

The center is known for managing high-net worth (HNWI peoples assets, having lucrative financial instruments, and for being an convenient place to...