By Kenneth Camilleri, Vertex Alliance, AKM-VERT-21

The Malta Permanent Residence Programme (MPRP) aims at granting permanent residency in Malta to third-country nationals who can also enjoy visa-free travel within the Schengen Zone for 90 days out of 180. If you are considering investing through this program and having Malta as your second home, below is all you need to know before starting the process:

- Facts about Malta

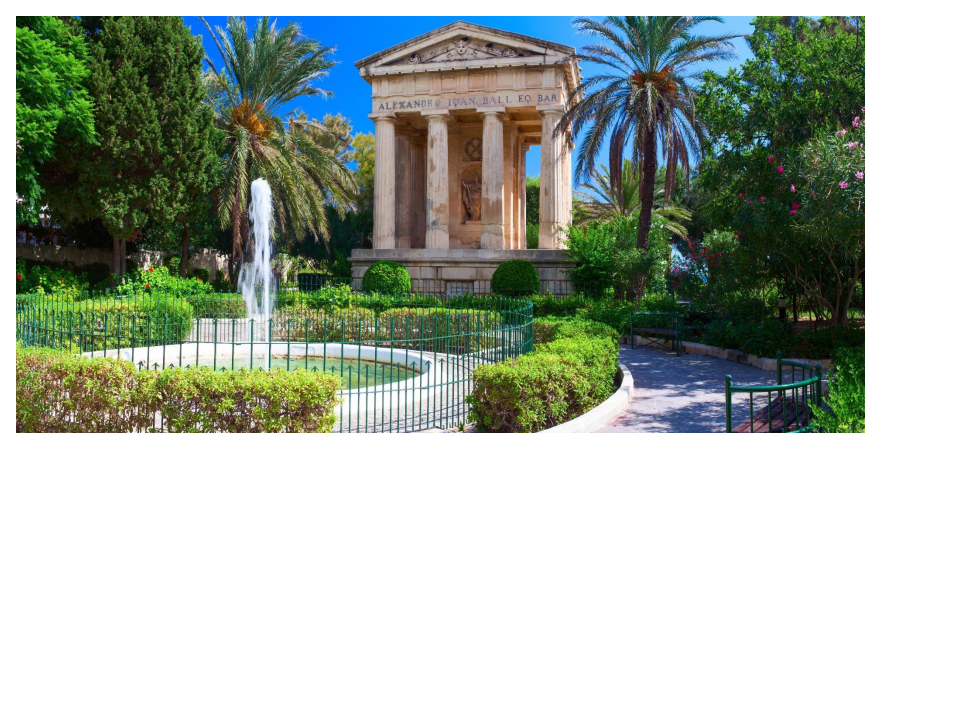

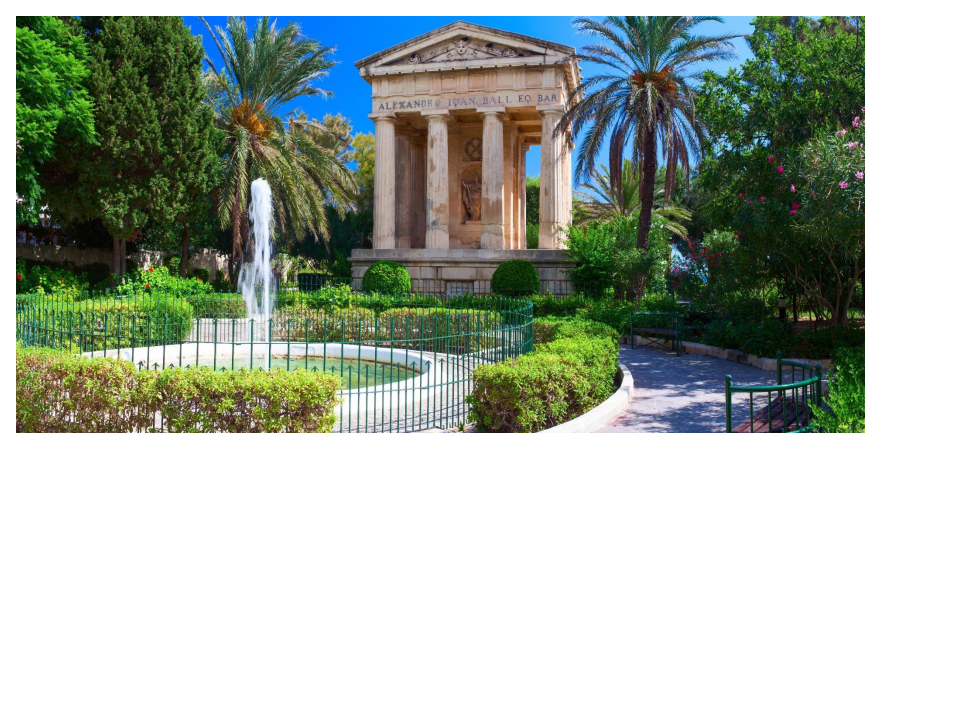

- Malta is located at the heart of the Mediterranean, 81 kilometers south of Sicily, Italy. Although a small state with an area of 316 square kilometers, Malta is rich in history and has both Maltese and English as official languages. It is a politically stable and secure country enjoying a sunny Mediterranean climate with approximately 300 days of sunshine per year.

- Eligibility for MPRP

- The MPRP is designed to attract third-country nationals. The applicant may include principally dependant family members up to four generations (spouse, children, parents, and grandparents of both the applicant and/or spouse). Members of the EU (European Union), EEA (European Economic Area), Switzerland, and those on a list of ineligible countries as issued by Residency Malta from time to time are prohibited to apply. Applicants must be in possession of €500,000 worth of assets of which €150,000 shall be in the form of financial assets.

- Qualifying property

- Applicants are to either purchase or rent a residential property. The minimum value for purchasing a residential property is €300,000 in the South of Malta/Gozo or €350,000 in the rest of Malta. For renting a residential property, the minimum value is €10,000 for properties in the South of Malta/Gozo or €12,000 for properties in the rest of Malta.

- Monetary contribution

- Based on the choice of property, applicants will have to settle a government contribution of €28,000 if the property is purchased or €58,000 if the property is rented. Furthermore, applicants must pay a non-refundable administrative fee of €40,000, and a €2,000 donation to a local Non-Governmental Organisation (NGO).

- Visits to Malta

- After the Letter of Approval in Principle is received, applicants are required to visit Malta to have their biometric data taken by Residency Malta and apply for the residence card.

- Submission of application

- Applications must be submitted to Residency Malta, the government entity responsible for Malta's residency-by-investment Program (MPRP). MPRP applications may only be submitted by Licensed Agents. Vertex Advisory is an Agent licensed to represent applicants in terms of their MPRP application.

- Timeline

- Applications can be compiled and submitted to the Agency in a matter of 1-2 months. The Agency applies a due diligence process and source of wealth analysis. The Agency will present the Licensed Agent with a final decision on the application within 4-6 months from submission (processing time may vary according to each application). Applicants must comply with the program's requirements within 8 months from the Letter of Approval in Principle.

Vertex Alliance is a Malta-based Advisory, licensed by the Government Agency to help clients and their families acquire permanent residence in Malta through investment.

You can find more details about the MPRP here.

Keep up-to-date, follow us on Wechat:

About the Author

Kenneth Camilleri - Managing Director

Kenneth is the Managing Director and co-founder of Vertex Alliance. By profession, Kenneth is a qualified and warranted accountant and tax advisor, and his expertise lies in residency and citizenship, international taxation, and wealth structuring. Previously, Kenneth held the position of Senior Director at an international law firm for a span of fifteen years, whereby he led both the Tax Advisory and Tax Compliance Departments as well as the Residency and Citizenship team responsible for the Asian market.

Over the years, Kenneth has spoken at more than eighty conferences and roadshows primarily in Asia but also across Europe. Numerous and diverse high net worth individuals have entrusted Kenneth with both their personal as well as corporate tax planning.

Professionally, Kenneth is best known for being an achiever who embraces challenges, for being a leader who inspires, and for his pragmatic and creative problem-solving skills.