China is now allowing foreign banks to sell and underwrite government bonds in the Shanghai Pilot Free Trade Zone.

According to a statement from the Zone, restrictions on international ratings agencies carrying on business in the Zone, and mandatory reviews or approvals for transactions by foreign insurers in the Zone have also been removed.

The changes follow the recent updating of the country's "negative list" of precluded foreign investments in the country's 11 free trade zones.

The latest negative list continues to bar foreign banks from payment and bank card business in the Zone, and the list makes clear the proportion of foreign capital in a securities firm cannot exceed 49 percent. The limit on shares held by a foreign investor in a listed domestic brokerage is unchanged at 20 percent for a single investor.

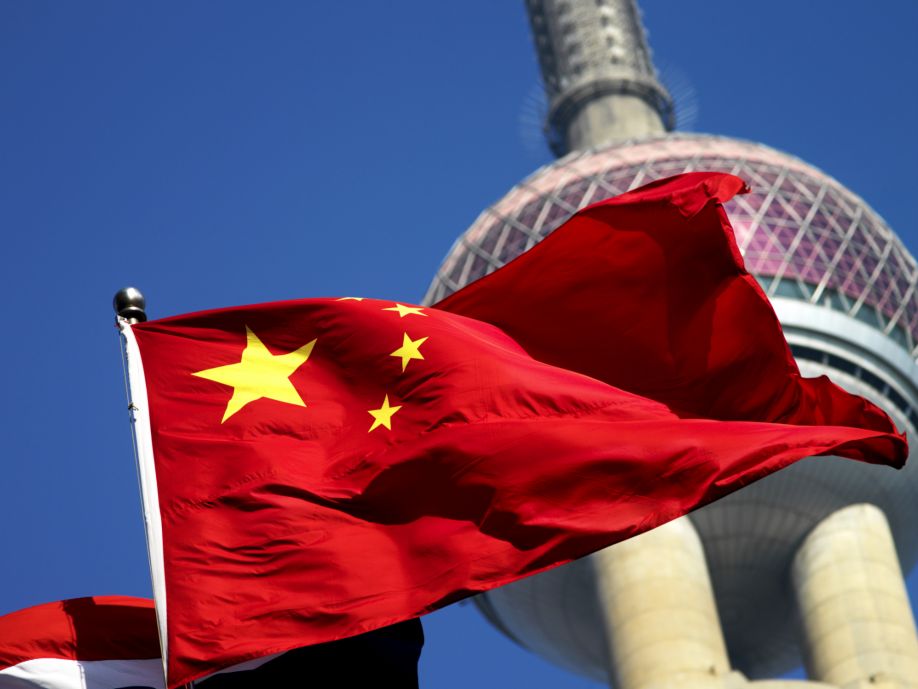

The Shanghai Pilot Free Trade Zone was created in 2013 and offers companies a number of tax preferences. It comprises a bonded area, high-tech park, financial area, and an export processing zone.