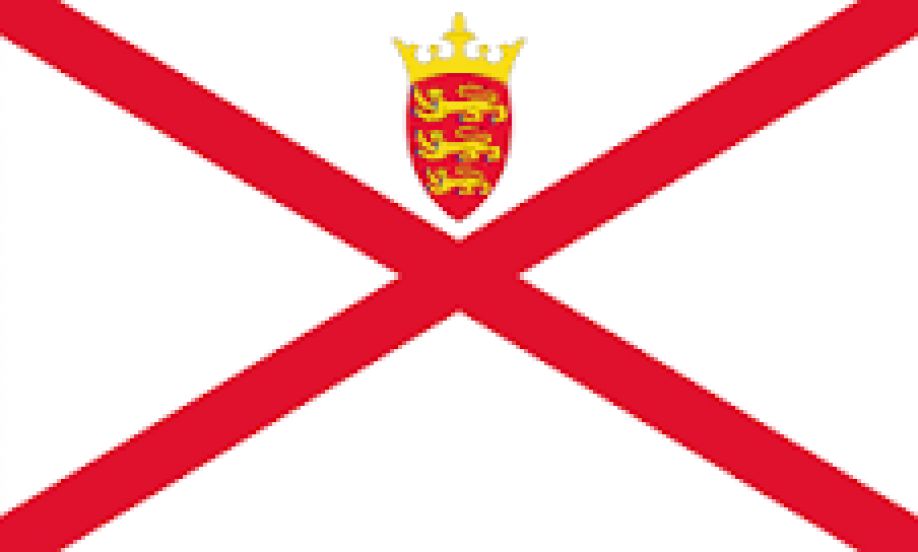

Jersey and the Isle of Man have each received the highest possible OECD rating in recognition of their compliance with global standards of information exchange in tax matters.

Each jurisdiction's tax transparency framework was subject to a peer review assessment carried out by a team of experts on behalf of the OECD's Global Forum on Transparency and Exchange of Information for Tax Purposes, the 147-member body that evaluates compliance with global standards of exchange of information.

The Global Forum's assessment is carried out in two phases. The first phase assesses a jurisdiction's legal and regulatory framework, and the second phase assesses whether this framework is being implemented. An overall rating of "compliant," "largely compliant," "partially compliant," or "non-compliant" is awarded on the general level of compliance with the standard.

The top rating of compliant was awarded to Jersey and the Isle of Man for the second phase assessment, and means both are now part of a select group of fewer than 10 other countries worldwide who have undergone second round reviews, ahead of most EU and G20 nations including the UK, USA, Germany, Australia, Luxembourg, and Canada.

Commenting on Jersey's top rating, Geoff Cook, CEO of Jersey Finance, the island's financial services promotion agency, said: "This is a real differentiator for Jersey and sends out a strong message that Jersey is serious about tax transparency, whilst also serving to reinforce just how unjustifiable the claims sometimes made against Jersey's position on tax transparency really are."

The Isle of Man's Treasury Minister, Alfred Cannan, also welcomed the positive rating, saying: "I am delighted the Isle of Man's high levels of international cooperation have been recognised in this way. It has become much harder to reach the standard required to achieve a top rating as the bar has been raised for this second round of reviews."

By Courtesy of Lowtax.net