Bermuda has signed up to a major international agreement on country-by-country financial reporting by multinational companies.

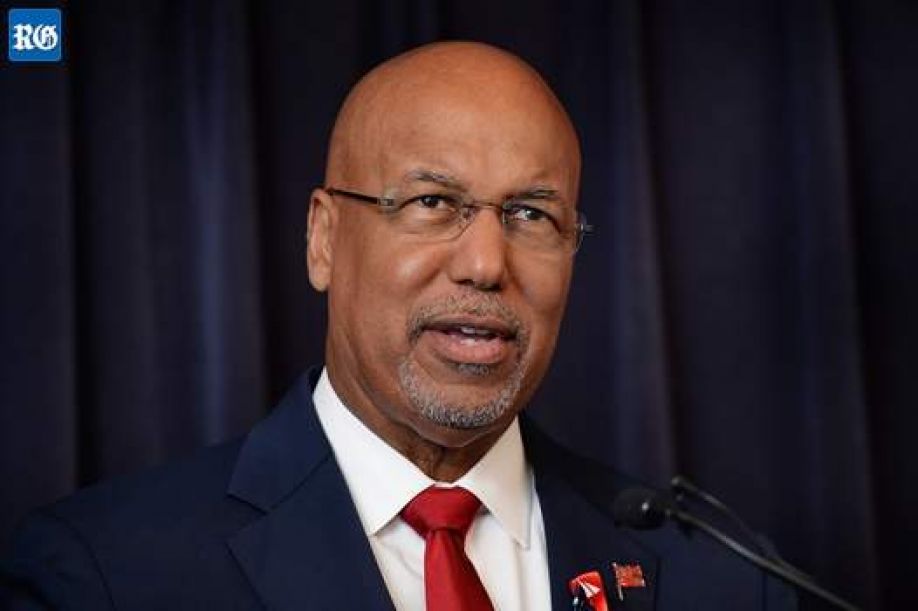

Bob Richards, the Minister of Finance, said Bermuda had fallen in line with the Organization for Economic Cooperation and Development reporting regime.

The move means companies with international operations will have to file detailed country-by-country reports by the end of next year.

The country-by-country reporting scheme follows Bermuda’s decision two years ago to adopt the OECD’s automatic tax information exchange regime, the common reporting standard.

Mr. Richards said: “We were one of the first jurisdictions in the world to sign up to the common reporting standard in 2014 as an early adopter of CRS and so I am proud Bermuda is again setting an example in adopting the country-by-country reporting regime without hesitation.

“Our government is committed to upholding international best practice in tax transparency.”

The country-by-country declaration will force multinational firms with headquarters in Bermuda to file financial information on a country basis.

The start date is in line with the UK, France and other countries.

By the Government of Bermuda