By Gerard Field

As a CEO of an international private bank, I find clients will spend much time and effort in selecting the right offshore jurisdiction for them taking into account the legal framework, regulations and whether the jurisdictions meet their individual requirements for what they require to be that asset protection, privacy, and strength of regulator to name a few key areas.

Once jurisdiction has been selected then a review of the banking partners that are available will be a key determinant of using that jurisdiction. Considerations will include how strong the bank is in terms of a balance sheet, capital ratios, staff experience, and skills, then the consideration of the products and services provided by the bank.

By the time you have selected your preferred banking partner, you want the account opening procedure to be as quick and as simple as possible. I detail below where areas that can cause confusion or uncertainty can be avoided and make for a smooth start to the banking relationship.

The Application Form

Banks construct their application forms as a means to collect the information they need to ensure the account is complete and meets their legal obligations. Incomplete application forms equal more time spent on follow-up correspondence. Ensure you read and fill out the bank’s application form in entirety. Some application forms may not be the easiest to follow so where you have any questions contact the bank directly to confirm the information they are requesting. Not completing parts of the form will lead to more queries.

Source of Wealth

The Bank needs to know how you accumulated your wealth. All banks have legal obligations to ensure they have an understanding of where the client’s wealth has been generated and is a key area the Bank takes into consideration when assessing new clients and you should have a very good idea of how you generated your wealth. It doesn’t need to be down the last dollar but should be detailed enough to satisfy the bank’s query.

Source of Funds

The Bank will need to know where the origin of the deposit is for your initial deposit and this should be a relatively easy question to answer. Is it from your local bank account, or are securities being sold? Perhaps a property is being sold? Be clear with the bank so they can check the veracity.

Purpose of Account

A key part of the bank’s obligations is to understand what the account is being used for so they will need to know why you’re setting up this account and where any payments will be going. Key areas the bank will be looking at in this instance will be the industry and the countries involved.

Politically Exposed Persons (PEP)

There is guidance given by Financial Action Task Force (FATF) on what a PEP is and the bank’s jurisdiction will also have guidance or specific legislation detailing what it has decided a PEP is. There is no stigma attached to being a PEP but it will cause the bank to undertake a more thorough due diligence process. More information on the source of wealth and the purpose of the account will be required.

Supporting Documentation

As you complete the form be sure to note where additional information and supporting documentation are required. Ensuring all supporting documentation if provided will greatly accelerate the account review process. Some banks will have a mobile app to be downloaded to verify passports or drivers’ licenses against a self-taken photo on a smartphone, a certification by a notary public or equivalent, or via a video conference call. These are a very quick and simple way to establish your physical identity.

Even with a remote account opening, it should be a simple procedure to open an offshore bank account. The bank is as keen as you to have a new business on board. So, make it easy by reading the application form and providing all the information asked for. Then you can enjoy the benefits of international banking.

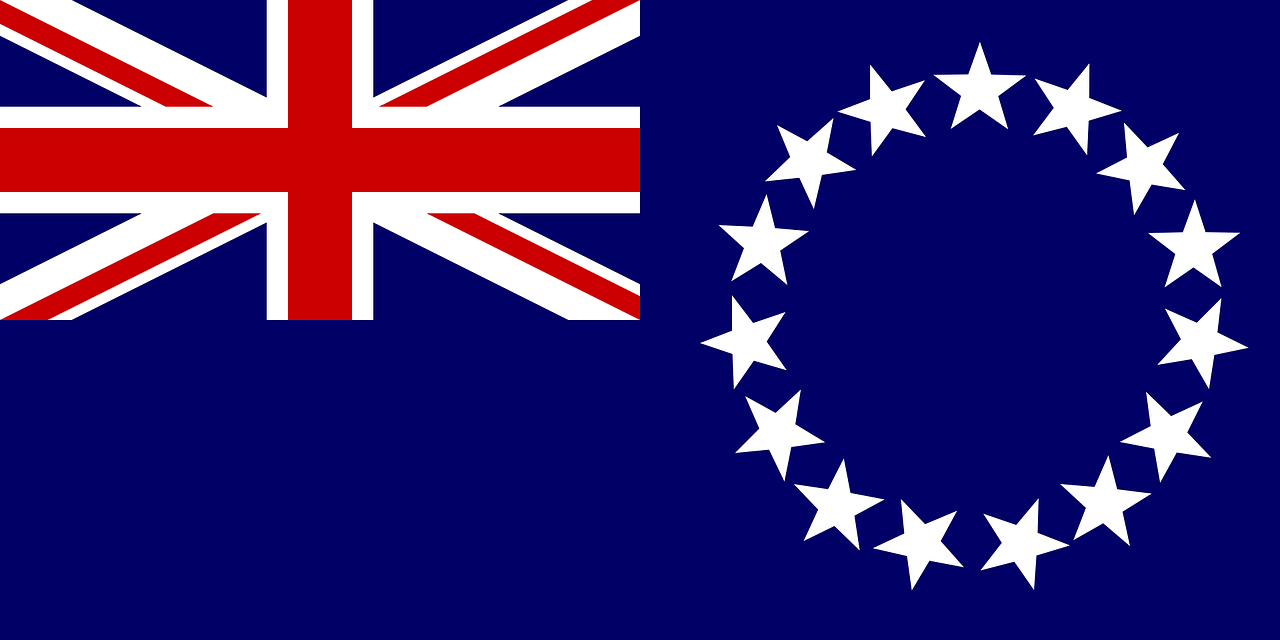

Gerard Field is CEO of Capital Security Bank an international private bank based in the Cook Islands.