By Reuters Staff

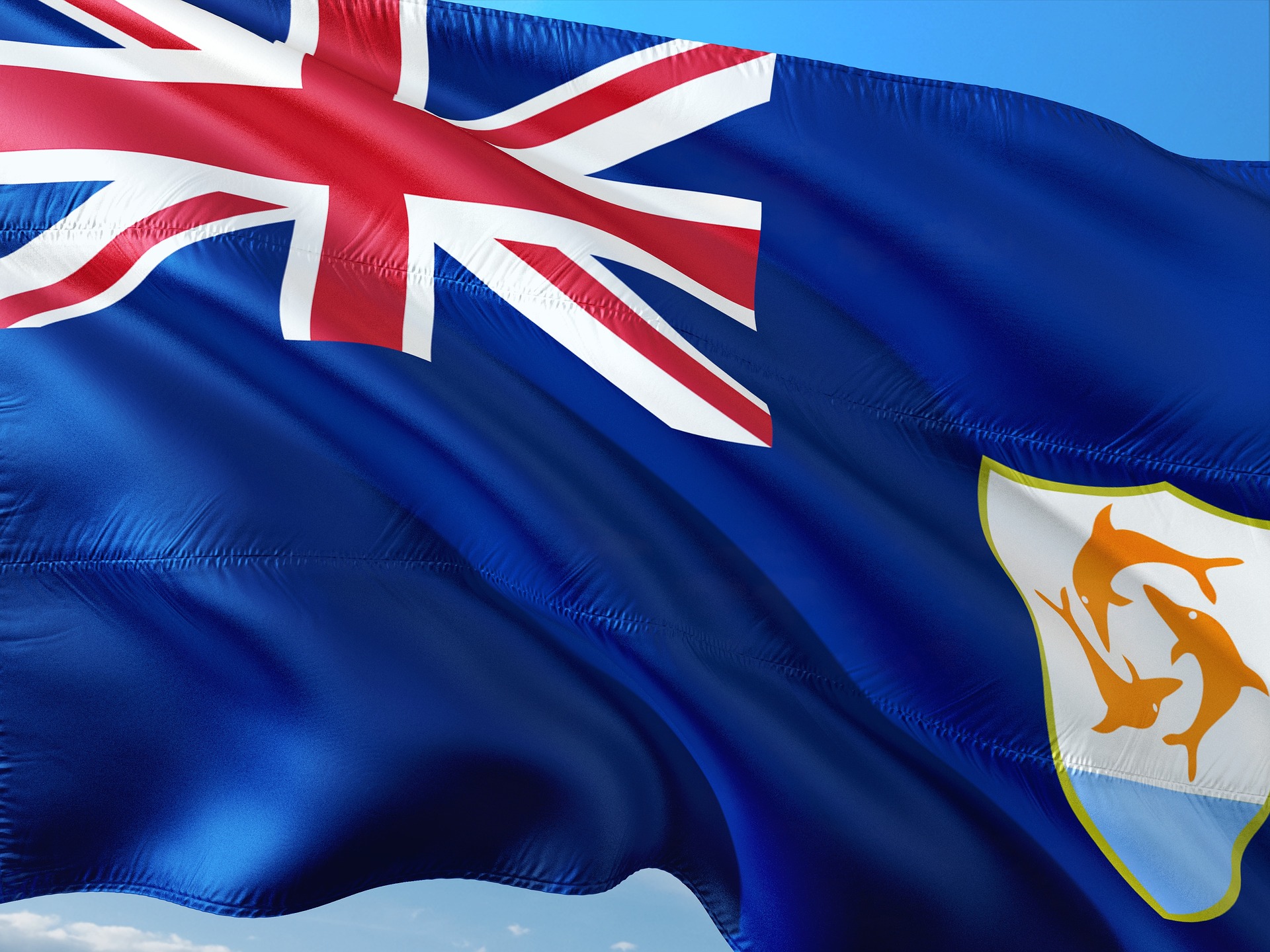

BRUSSELS (Reuters) - European Union finance ministers added Anguilla and Barbados to the EU’s blacklist of tax havens on Tuesday and removed the Cayman Islands and Oman after they passed the necessary reforms.

The EU list, set up in 2017 after revelations of widespread tax evasion and avoidance schemes, now includes 12 jurisdictions: American Samoa, Anguilla, Barbados, Fiji, Guam, Palau, Panama, Samoa, Seychelles, Trinidad and Tobago, the U.S. Virgin Islands and Vanuatu.

Those on the blacklist face reputational damages, higher scrutiny in their financial transactions, and risk losing EU funds.

Source: Reuters