By Yao Lu

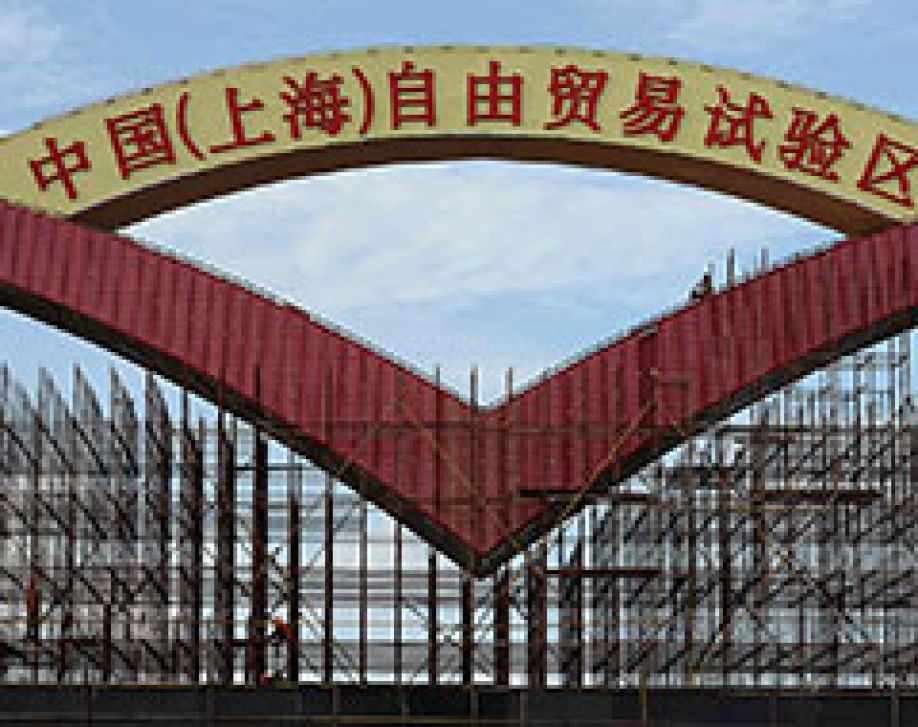

Since first opening in September 2013, investors and businesses have flocked to the Shanghai FTZ. According to local media reports, more than 4,600 new companies, including 280 foreign-invested enterprises (FIEs), were established in the Zone as of January 14, 2014. This surge can be attributed to the Zone relaxed requirements and streamlined approval procedures for company establishment, which we will further describe below.

Relaxed Incorporation Requirements

The Zone cancels out the minimum registration capital of RMB30,000 for limited liability companies, the RMB100,000 minimum for single shareholder companies, and the RMB5 million minimum for joint stock companies. Moreover,...